On the UAE Markets

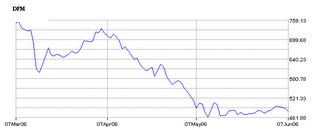

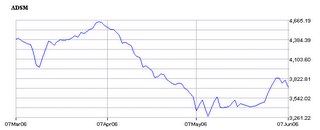

The last two weeks in the DFM and ADSM saw one way rise and then correction. Good news came from the Abu Dhabi pension fund that they perceive the UAE markets as good on valuations. Investors took it positively and the daily turnover in the ADSM which was languishing at around AED 150mn rose sharply to more than AED 1bn in the past few trading sessions. Blue chips like Etisalat and few banks showed some sign of strength. However the rise was short lived and the markets went down during this week and shed most of the rise they had during last week. ADSM which was at 3420 on 25th May touched 3833 on 3rd June before closing today (7th June) at 3597, and DFM was at 473 on 25th May touch almost 500 on 5th June before closing today at 470.

At present level, the UAE markets are at PE of 12-14 with quality stocks at the same PE level. Margins and Cash flows are robust and the balance sheets of good UAE companies’ are not very leveraged to take a hit in case of rising interest rate scenario. Etisalat is having cash surplus and so is Emaar- two heavyweights in the UAE markets.

UAE banks also share the same story. The banks' leverage ratio (Total Assets/ Equity) of 6-10x is not very high as compared to big banks in the markets like The US, UK, or emerging market like India (12-18x) and their NIM is also very good of 3-4% and ROA of 3% (which is infact much better if you compare this with Indian or the US banks). HSBC’s ROA and Leverage is 1.1% and 16.5x, while Bank of America has 1.5% and 12.5x respectively as at 2005 end. Even CAR of local banks are also well above 12% as required by Basel II.

It will take a while to boost the confidence of the investors here, till then I welcome the consolidation phase of the markets with good volume. And my support levels remain the same i.e. 3250 for ADSM and 420-430 for DFM…in the worst case that is.

At present level, the UAE markets are at PE of 12-14 with quality stocks at the same PE level. Margins and Cash flows are robust and the balance sheets of good UAE companies’ are not very leveraged to take a hit in case of rising interest rate scenario. Etisalat is having cash surplus and so is Emaar- two heavyweights in the UAE markets.

UAE banks also share the same story. The banks' leverage ratio (Total Assets/ Equity) of 6-10x is not very high as compared to big banks in the markets like The US, UK, or emerging market like India (12-18x) and their NIM is also very good of 3-4% and ROA of 3% (which is infact much better if you compare this with Indian or the US banks). HSBC’s ROA and Leverage is 1.1% and 16.5x, while Bank of America has 1.5% and 12.5x respectively as at 2005 end. Even CAR of local banks are also well above 12% as required by Basel II.

It will take a while to boost the confidence of the investors here, till then I welcome the consolidation phase of the markets with good volume. And my support levels remain the same i.e. 3250 for ADSM and 420-430 for DFM…in the worst case that is.

0 Comments:

Post a Comment

<< Home